Remember the last time you bought insurance the “old-fashioned” way? You probably had to schedule an appointment, drive to an office, wait in a lobby, and then spend an hour listening to a sales pitch. It felt more like a chore than a purchase. Fortunately, the digital revolution has transformed this entire experience, turning a tedious afternoon errand into a ten-minute task you can finish while your coffee brews.

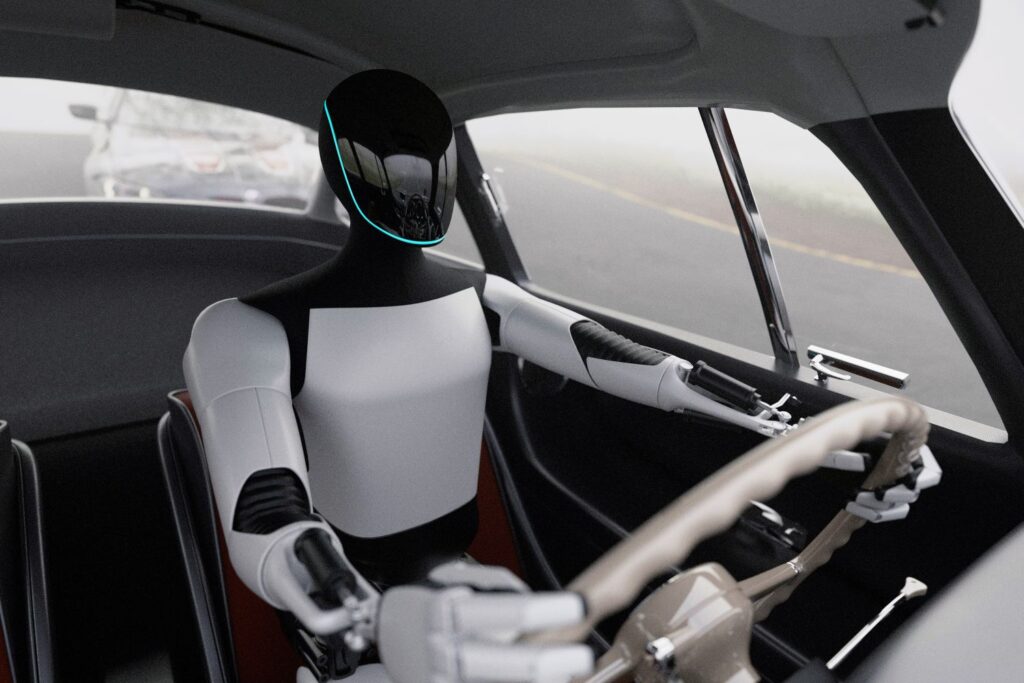

Buying car insurance online isn’t just about avoiding a commute; it is about taking control of your financial decisions. When you remove the physical barriers to entry, you gain access to a marketplace that operates on your schedule, not banking hours. You can compare rates at midnight, adjust your coverage during a lunch break, or download proof of insurance while standing in the dealership parking lot.

The shift towards digital platforms is happening globally because drivers value efficiency. Whether you are insuring a sedan in San Francisco or searching for car insurance Qatar to cover your SUV in Doha, the digital advantages are universal. The internet has standardized the buying experience, making it faster, cheaper, and far more transparent for everyone involved.

But what exactly do you gain by ditching the traditional agent? While speed is the most obvious perk, the benefits run much deeper. From significant cost savings to the ability to customize your policy without sales pressure, moving your insurance business online offers distinct advantages that modern drivers shouldn’t ignore.

1. Significant Cost Savings

One of the most compelling reasons to switch to online insurance is the potential for lower premiums. Traditional insurance agencies have high overhead costs. They have to pay for office rent, electricity, support staff, and commissions for their agents. When you buy through a local broker, a portion of your premium effectively goes toward keeping their lights on.

Online insurers operate with a much leaner model. By selling directly to the consumer, they eliminate the middleman and drastically reduce their operational expenses. In a competitive market, companies often pass these savings directly to you.

Furthermore, digital platforms make it incredibly easy to spot the best deal. You can use aggregator sites to see multiple quotes side-by-side. This visibility forces insurers to be competitive with their pricing. You might find that the exact same coverage costs 15% less simply because you bought it through a website rather than over the phone.

2. Unmatched Convenience and Speed

We live in an on-demand world. We stream movies instantly, order groceries to our door, and manage our banking from our phones. Why should car insurance be any different? The traditional model of insurance forces you to operate on someone else’s timeline. If you remember you need to renew your policy at 8:00 PM on a Friday, you are usually out of luck until Monday morning.

Online insurance platforms are open 24/7. This flexibility is a game-changer for shift workers, busy parents, or anyone who simply values their time. The process is streamlined for speed:

- Instant Quotes: Enter your info once and get a price in seconds.

- Immediate Coverage: Pay online and you are insured instantly.

- Digital Documents: No waiting for snail mail. Your ID cards are emailed to you or available in an app immediately.

3. Transparency and Empowerment

There is often a “black box” feeling when dealing with a human agent. They might type some numbers into their computer and tell you a final price, but you rarely see how they got there. Did they add roadside assistance? Did they choose the highest deductible? It can be hard to know without asking uncomfortable questions.

Online platforms strip away this mystery. You are the one driving the process. You can toggle different options to see exactly how they impact your premium.

- Adjust Deductibles: Slide the bar from $500 to $1,000 and watch the premium drop instantly.

- Coverage Limits: See the price difference between state minimums and higher liability limits.

- Add-ons: Check or uncheck boxes for rental car reimbursement or gap insurance based on your actual needs.

This transparency empowers you to build a policy that fits your budget and your risk tolerance, rather than settling for a “standard” package an agent assumes you want.

4. No Sales Pressure

Let’s be honest: nobody likes being sold to. Insurance agents often work on commission, which means they have a financial incentive to sell you more coverage than you might need. This can create an awkward dynamic where you feel pressured to agree to up-sells just to end the conversation.

When you buy online, you remove the sales pressure entirely. You can take your time to read the fine print. You can Google terms you don’t understand without feeling embarrassed. You can leave the page and come back a day later after thinking it over. This pressure-free environment leads to better decision-making because you are purchasing based on logic and research, not emotion or social obligation.

5. Easy Policy Management

The benefits of going digital extend well beyond the initial purchase. Managing your policy online is significantly easier than calling an agent for every little change.

Modern insurance apps and customer portals allow you to handle almost all administrative tasks yourself:

- Adding a Driver: Did your teenager just get their license? Add them to the policy in minutes.

- Changing Vehicles: Traded in your old car? Update the vehicle details on your phone while you’re still at the dealership.

- filing Claims: Many providers now allow you to file claims by uploading photos of the damage directly through their app, speeding up the payout process.

Conclusion

Buying car insurance online is no longer just an alternative; for many, it is the superior choice. It respects your time, saves you money, and puts you in the driver’s seat of your own financial protection. The days of confusing paperwork and lengthy office visits are fading, replaced by a streamlined, transparent digital experience.

If your renewal is coming up, don’t just auto-renew out of habit. Take ten minutes to explore online options. You might be surprised at how much control—and cash—you can get back simply by logging on.