The financial services industry stands at the intersection of tradition and innovation, where established institutions and emerging startups alike recognize that digital transformation is no longer optional but essential for survival and growth. Modern financial organizations require technological solutions that can scale dynamically with business growth, adapt rapidly to changing market conditions, integrate seamlessly with existing systems, and deliver exceptional user experiences across multiple channels. This demanding environment has created a specialized discipline focused on creating flexible, robust, and future-proof financial technology platforms.

Fintech app development solutions encompass far more than writing code and deploying applications. These comprehensive offerings address the entire lifecycle of financial software, from strategic planning and architecture design through development, testing, deployment, and continuous optimization. The holistic nature of these solutions ensures that organizations receive not just functional applications but complete ecosystems that support their business objectives, comply with regulatory requirements, and provide competitive advantages in increasingly crowded markets.

Architecture decisions made during the initial planning phases have profound implications for an application’s ability to scale and adapt over time. Fintech app development solutions typically employ microservices architectures that decompose complex financial systems into smaller, independently deployable components. This architectural approach enables organizations to scale specific services based on demand, update individual components without affecting the entire system, and allocate development resources efficiently across multiple teams working on different services simultaneously.

Cloud-native development practices form the foundation of scalable financial applications, leveraging infrastructure services provided by major cloud platforms to achieve elasticity, reliability, and global reach. Development teams architect solutions that automatically scale computing resources in response to traffic patterns, distribute workloads across multiple geographic regions to reduce latency and improve availability, and implement disaster recovery strategies that ensure business continuity. Container technologies and orchestration platforms facilitate consistent deployment across development, testing, and production environments while simplifying infrastructure management.

Database strategies for fintech app development solutions must balance transactional integrity with performance and scalability. Development teams often implement polyglot persistence approaches that use different database technologies optimized for specific use cases—relational databases for transactional data requiring ACID properties, NoSQL databases for high-volume, flexible-schema data, in-memory databases for real-time analytics, and distributed ledgers for immutable audit trails. Database sharding, read replicas, and caching layers further enhance performance and scalability.

API-first development methodologies recognize that modern financial applications exist within ecosystems of interconnected services and must expose their functionality to internal systems, partner organizations, and third-party developers. Fintech app development solutions create well-documented, versioned APIs that follow industry standards such as REST or GraphQL, implement rate limiting and authentication mechanisms, and provide developer portals with testing tools and documentation. This approach enables rapid integration, facilitates partnerships, and potentially creates new revenue streams through API monetization.

Technoyuga delivers specialized expertise in creating scalable financial technology platforms that address the complex requirements of modern financial services. The organization’s solutions combine architectural best practices with practical implementation strategies, resulting in systems that perform reliably under demanding conditions while remaining flexible enough to accommodate future innovations and business model changes.

Performance optimization represents an ongoing discipline within fintech application development, as user expectations for speed and responsiveness continue to rise. Development teams employ profiling tools to identify bottlenecks, implement asynchronous processing for time-consuming operations, optimize database queries, and leverage content delivery networks to minimize data transfer times. These optimizations ensure that applications deliver consistently fast experiences regardless of user location or system load.

Regulatory compliance and governance frameworks built into fintech app development solutions address the complex web of financial regulations governing different jurisdictions and product types. Development teams implement configurable business rule engines that codify regulatory requirements, create audit logging systems that document every system interaction, and build reporting tools that generate compliance documentation. This proactive approach to compliance reduces regulatory risk while simplifying the process of adapting to new regulations.

DevOps practices and continuous integration/continuous deployment pipelines accelerate the delivery of new features and improvements while maintaining quality and stability. Automated testing frameworks verify functionality at unit, integration, and system levels, while infrastructure-as-code practices ensure consistent, reproducible deployments. Monitoring and observability tools provide real-time insights into application performance, user behavior, and potential issues, enabling teams to respond proactively to problems.

Multi-tenancy support enables fintech app development solutions to serve multiple organizations or customer segments from a single application instance while maintaining data isolation and customization capabilities. This architectural approach reduces infrastructure costs, simplifies maintenance, and enables rapid onboarding of new clients. Configuration management systems allow customization of features, branding, and business rules for different tenants without code changes.

Open banking and embedded finance trends have created demand for financial applications that can integrate seamlessly into non-financial contexts, enabling commerce platforms, ride-sharing apps, and retail businesses to offer financial services within their existing applications. Development teams create white-label solutions and embeddable components that deliver financial functionality while maintaining the host application’s look and feel.

Data analytics and business intelligence capabilities transform the vast amounts of data generated by financial applications into actionable insights. Development teams implement data warehousing solutions, create ETL pipelines that consolidate information from multiple sources, and build visualization dashboards that present complex financial data in understandable formats. Machine learning models analyze historical data to predict future trends, identify opportunities, and support data-driven decision making.

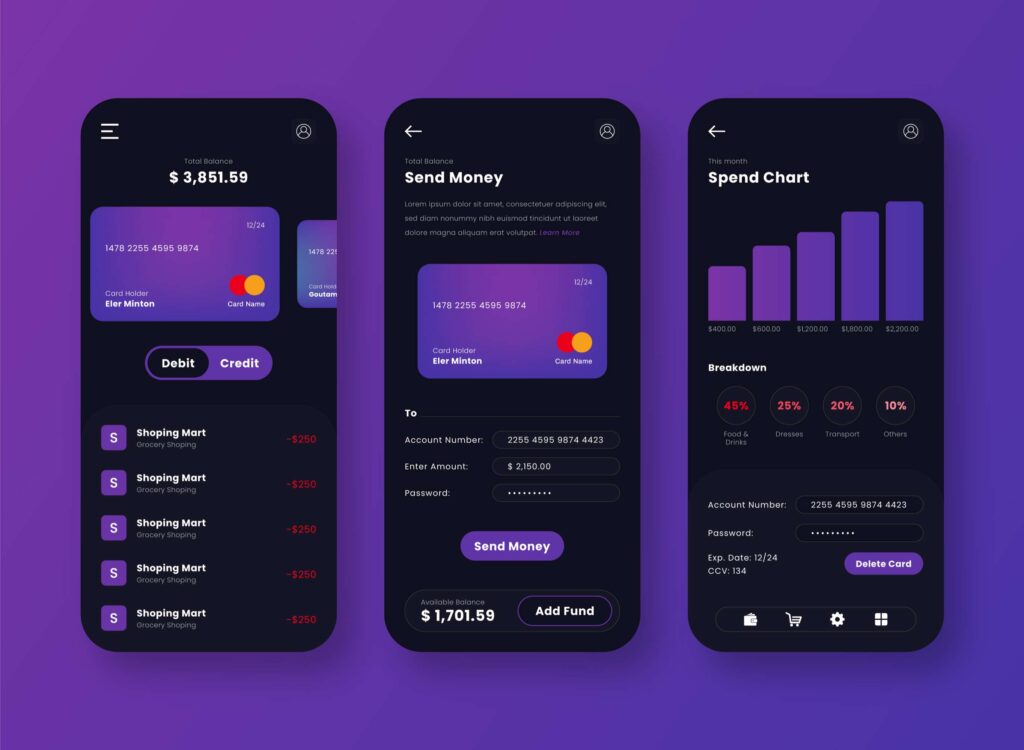

Mobile-first development strategies recognize that smartphones have become the primary interface for financial services for many users. Fintech app development solutions prioritize mobile experiences, implementing responsive designs that adapt to various screen sizes, leveraging native device capabilities such as biometric authentication and push notifications, and optimizing performance for mobile network conditions. Progressive web apps provide app-like experiences through web browsers, reducing friction associated with app installation while maintaining broad device compatibility.

Internationalization and localization capabilities enable financial applications to serve global markets while respecting local preferences, regulations, and cultural norms. Development teams implement multi-language support, adapt date and number formats to regional conventions, integrate local payment methods, and ensure compliance with jurisdiction-specific financial regulations. This global perspective expands market opportunities while acknowledging regional differences.

The complexity of modern financial services requires sophisticated workflow management and process automation capabilities. Development teams implement business process management systems that orchestrate complex, multi-step workflows spanning multiple systems and human approvals. Automation reduces manual effort, minimizes errors, and ensures consistent process execution while maintaining audit trails that document every action and decision.

As financial technology continues to evolve with innovations such as decentralized finance, artificial intelligence-driven financial advisors, and embedded banking, the importance of comprehensive development solutions that can adapt to these changes while maintaining stability and security becomes increasingly apparent. Organizations that invest in scalable, well-architected financial technology platforms position themselves to capitalize on emerging opportunities while serving their customers with increasingly sophisticated, personalized, and convenient financial services that define the future of the industry.